Regulatory Exclusivity: How Non-Patent Protections Delay Generic Drugs

Nov, 28 2025

Nov, 28 2025

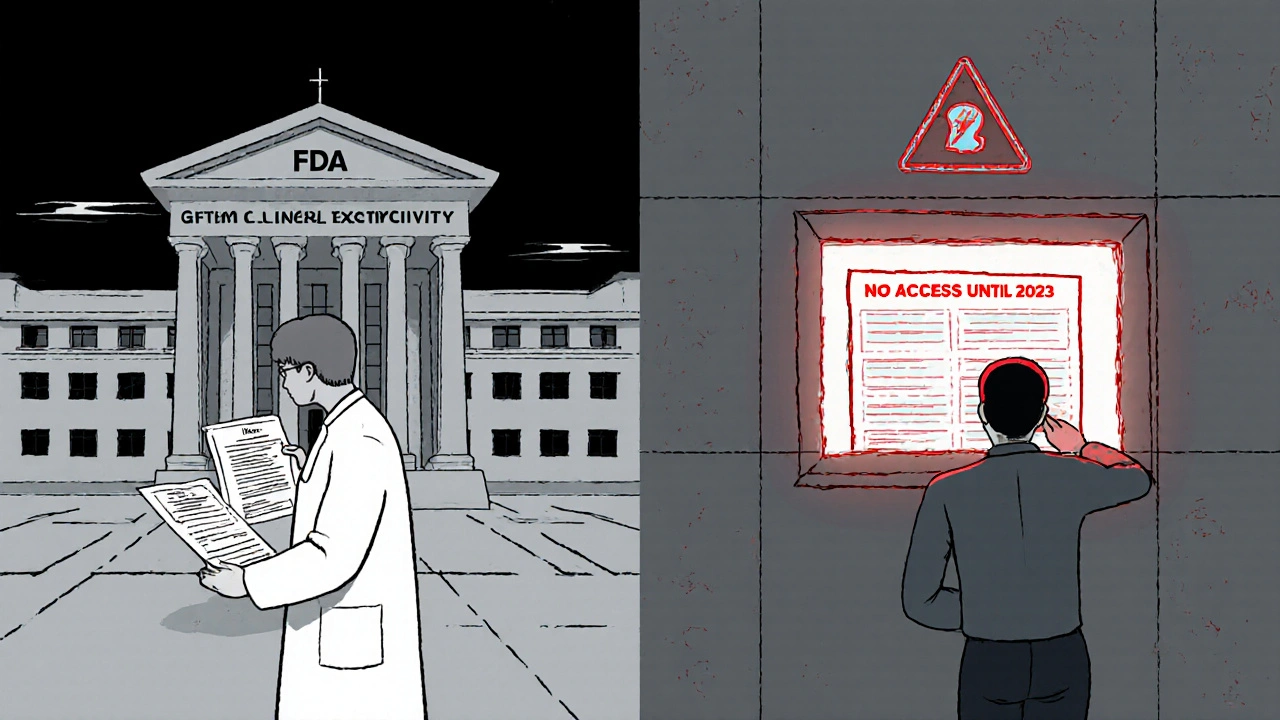

When a new drug hits the market, you might assume its high price is protected by a patent. But in many cases, the real barrier to cheaper generics isn’t a patent at all-it’s regulatory exclusivity. This is a government-granted clock that starts ticking not when the drug is invented, but when it’s approved by the FDA. During this time, no generic or biosimilar version can even be reviewed for approval, no matter how simple or obvious the copy might seem.

What Exactly Is Regulatory Exclusivity?

Regulatory exclusivity is a legal shield built into U.S. drug laws. It doesn’t protect an invention like a patent does. Instead, it protects the data used to prove a drug is safe and effective. If you’re a drugmaker and you spend $2 billion and 12 years developing a new medicine, the FDA won’t let another company use your clinical trial data to get their version approved for a set number of years. That’s exclusivity. It’s automatic. You don’t file for it. You just get it when your drug is approved-if you meet the criteria.Think of it this way: patents say, "You can’t make this exact molecule." Exclusivity says, "You can’t even look at how we proved it works." That’s why even if a patent expires in year 7, the drug might still be protected until year 12. The FDA literally can’t approve a generic until the clock runs out.

The Four Main Types of Exclusivity in the U.S.

Not all exclusivity is the same. The FDA grants different lengths depending on what kind of drug you’re making.- New Chemical Entity (NCE) Exclusivity: 5 years - This is the most common. If your drug contains a molecule no one’s ever approved before, you get five years of protection. For the first four years, the FDA won’t even accept an application from a generic company. At year five, they can approve it-but only if it doesn’t infringe on any patents.

- Orphan Drug Exclusivity: 7 years - For drugs treating rare diseases (fewer than 200,000 patients in the U.S.). Even if another company makes the same drug for a different rare disease, they can’t get approval during your 7-year window. This rule helped spark the rise of specialty drugs for conditions like cystic fibrosis and certain cancers.

- Biologics Exclusivity: 12 years - Biologics are complex drugs made from living cells-like insulin, monoclonal antibodies, or cancer therapies. They’re harder to copy than pills. So Congress gave them 12 years of protection under the BPCIA law. That’s longer than any other type. Humira, for example, kept its monopoly until 2023, even though its main patent expired in 2016.

- 3-Year Exclusivity - If you add a new use, dosage, or delivery method to an already-approved drug, and you had to run new clinical trials to prove it, you get three years. This doesn’t block generics of the original drug, but it stops competitors from copying your new version.

These periods often overlap with patents. But here’s the kicker: exclusivity doesn’t care if your patent is weak or gets thrown out in court. The FDA follows the law, not the lawsuit.

How It’s Different from Patents

Patents and exclusivity sound similar, but they’re not the same.| Feature | Regulatory Exclusivity | Patent |

|---|---|---|

| Who grants it? | Food and Drug Administration (FDA) | U.S. Patent and Trademark Office (USPTO) |

| When does it start? | On drug approval | On patent filing (often years before approval) |

| What does it protect? | The drug product and its clinical data | A specific invention, formula, or method |

| Can it be challenged? | No. It’s automatic if criteria are met. | Yes. Generic companies often sue to invalidate patents. |

| Duration | Fixed: 5, 7, 12, or 3 years | 20 years from filing (but often reduced by approval delays) |

That’s why big pharma loves exclusivity. If your drug takes 10 years to get approved, your 20-year patent might be down to 10 years left. But exclusivity? It still gives you the full 5 or 12 years from day one of approval. No guesswork. No lawsuits. Just a guaranteed window to make money.

Why It Matters for Drug Prices

You’ve probably noticed how some drugs cost thousands of dollars a month. Exclusivity is one of the biggest reasons why.IQVIA found that drugs under exclusivity sell for 3.2 times more than their generic versions. For biologics, the gap is even wider. Humira made $19.9 billion in the U.S. in 2022 alone-despite being off-patent for years. Why? Because no biosimilar could legally enter until the 12-year exclusivity ended.

That’s not an accident. The system was designed to reward innovation. But critics argue it’s gone too far. Public Citizen says extended exclusivity keeps prices high longer than needed. A 2024 survey by the Association for Accessible Medicines found that 68% of generic manufacturers think the 12-year biologics term is too long. Meanwhile, 89% of originator companies say it’s essential to recover R&D costs.

There’s no perfect balance. But the numbers don’t lie: 88% of new drugs approved between 2018 and 2023 got at least one form of exclusivity. That means almost every new drug gets a head start on competition.

Global Differences

The U.S. isn’t the only player. Other countries have their own rules.- European Union: Uses an "8+2+1" system. Eight years of data protection, two years of market exclusivity, and a possible extra year for new uses.

- Japan: Grants 10 years of data exclusivity for new chemical drugs.

- EU Proposals: In 2023, the European Commission proposed cutting data exclusivity from 8 to 6 years to speed up cheaper drug access.

The U.S. is one of the most generous. That’s why many drugmakers file first in the U.S. before expanding elsewhere. It’s not just about market size-it’s about how long they can charge premium prices.

How Companies Use It Strategically

Big pharma doesn’t just wait for exclusivity to kick in-they plan for it.Take AbbVie and Humira. They didn’t just rely on one patent. They filed over 100 patents, layered exclusivity, and used legal tactics to delay biosimilars. Even after patents expired, the 12-year exclusivity kept competitors out until 2023. That’s a 7-year head start after the patent clock ran out.

For orphan drugs, companies sometimes target ultra-rare diseases just to get the 7-year window. It’s legal. It’s strategic. And it’s common. In 2023, nearly half of all new drug approvals were for orphan indications-up from just 18% in 2010.

Companies hire full-time exclusivity managers. Their job? Track every expiration date across every market. One mistake, and a generic could slip in early. According to Excelon IP, 73% of major drugmakers have dedicated teams just for this.

What’s Changing?

The system isn’t frozen. Pressure is building.- Legislative Proposals: The "Affordable Prescriptions for Patients Act" tried to cut biologics exclusivity from 12 to 10 years. It stalled due to lobbying.

- FDA’s New Focus: The FDA’s 2024-2026 Drug Competition Action Plan says it wants to "modernize exclusivity frameworks" to better balance innovation and access.

- Tufts Forecast: By 2030, the average total exclusivity period (patent + regulatory) could drop from 12.3 years to 10.8 years.

But don’t expect exclusivity to disappear. Even critics agree: without it, companies wouldn’t invest billions in risky, long-term drug development. The question isn’t whether exclusivity should exist-it’s how long it should last.

What This Means for Patients and Providers

If you’re a patient, exclusivity means waiting longer for cheaper versions. If you’re a doctor, it means fewer affordable options on the formulary. If you’re a pharmacist, it means explaining why a drug is still expensive even though it’s been on the market for a decade.It also means the system is working exactly as designed-just not always as intended. The goal was to reward innovation while letting generics in after a fair time. But in practice, exclusivity often extends monopoly pricing well beyond what’s needed to recoup R&D.

The bottom line? Regulatory exclusivity is a powerful, invisible force shaping what you pay for medicine. It’s not about patents. It’s about rules. And those rules are written in law, not in courtrooms.

Is regulatory exclusivity the same as a patent?

No. A patent protects the invention itself and is granted by the patent office. Regulatory exclusivity protects the drug’s approval data and is granted automatically by the FDA after approval. Patents can be challenged in court; exclusivity cannot.

Can a drug have both patent and exclusivity protection?

Yes, and most do. Many drugs have patents that expire years before approval, so exclusivity ensures the company still has market protection. For example, a biologic might lose its patent in year 8 but keep exclusivity until year 12.

Why do generic drugs still cost so much even after exclusivity ends?

After exclusivity ends, generics can enter-but not always immediately. Some companies delay entry by filing lawsuits over remaining patents, or by making small changes to the drug to qualify for new exclusivity. Also, if only one or two generics enter the market, prices may not drop as much as expected.

Does regulatory exclusivity apply to all types of drugs?

No. It applies to new chemical entities, biologics, orphan drugs, and drugs with new clinical data. Over-the-counter drugs, supplements, and older generics don’t qualify. Cell therapies and gene therapies often fall outside traditional exclusivity rules because they’re too complex to copy.

How can I check if a drug still has exclusivity?

The FDA’s Purple Book database lists all biologics and their exclusivity status. For small-molecule drugs, you can search the Orange Book for patents, but exclusivity info is harder to find publicly. Most consumers rely on pharmacists or pharmacy benefit managers to know when generics become available.

Jerry Ray

November 29, 2025 AT 14:54So let me get this straight-you’re telling me a company can spend $2 billion on a drug, then get 12 years of free monopoly just because they used living cells? That’s not innovation, that’s legalized extortion. And don’t give me that ‘R&D needs protection’ crap-most of that money goes to marketing and executive bonuses. I’ve seen the财报. The real innovation is in finding loopholes, not curing diseases.

David Ross

November 29, 2025 AT 19:44Let’s be clear: this isn’t about ‘big pharma’-it’s about American ingenuity. We fund the research. We approve the drugs. We bear the risk. And now you want to hand the fruits of that labor to foreign competitors who don’t even have the infrastructure to replicate it properly? The 12-year exclusivity is a national security issue. If we don’t protect our innovators, China and India will own the next decade of medicine-and you’ll be begging them for insulin.

Sophia Lyateva

November 30, 2025 AT 18:09wait so u mean the fda is in cahoots with big pharma?? like... the whole system is rigged?? i read somewhere that the fda takes donations from drug cos and then they just approve stuff without real testing?? like... why do they even have a ‘purple book’ if no one can access it?? i think the fda is just a front for the illuminati and they’re using drug prices to control the masses??

AARON HERNANDEZ ZAVALA

December 1, 2025 AT 17:59I get both sides here. On one hand, if companies can’t make a return, they won’t invest in risky drugs for rare diseases. On the other, 12 years is a long time when people are dying waiting for affordable options. Maybe there’s a middle ground-like tiered exclusivity based on actual R&D cost or patient impact. Not all drugs are created equal. Some are miracle cures. Others are just slightly better versions of something that already exists. We need to reward the real breakthroughs, not the tweaks.

Lyn James

December 1, 2025 AT 22:26Let’s not pretend this is about science or public health-it’s about moral decay. We’ve turned healing into a profit-driven enterprise where the sanctity of human life is reduced to a balance sheet. When a child with cystic fibrosis can’t breathe because their parents can’t afford the drug that keeps them alive, and that drug is protected by a bureaucratic loophole designed by lobbyists in D.C., we are not a civilization-we are a corporation with a flag. The 12-year exclusivity isn’t a policy; it’s a sin. And we are all complicit because we don’t rise up. We scroll. We complain. We click ‘like.’ But we don’t demand change. We’ve forgotten what justice looks like. And now, the sick pay the price with their lives.

Craig Ballantyne

December 2, 2025 AT 15:47From a policy economics standpoint, the current framework exhibits a suboptimal welfare outcome due to prolonged rent-seeking behavior. The 12-year biologics exclusivity creates a persistent deadweight loss, suppressing consumer surplus while inflating producer surplus beyond the social optimum. The marginal cost of production for biosimilars is negligible post-development, yet pricing remains monopolistic. A calibrated reduction to 8–9 years, coupled with accelerated FDA review pathways, would enhance allocative efficiency without materially disincentivizing innovation. The EU’s 8+2+1 model offers a more balanced precedent.

Victor T. Johnson

December 3, 2025 AT 00:19Look. I’m not against innovation. I’m against lying. You say exclusivity is for R&D? Then why do the same companies spend 3x more on ads than on actual research? Why do they file 100 patents on one drug just to drag out the clock? Why do they tweak a pill’s coating and call it a ‘new use’ to reset the timer? This isn’t capitalism. This is fraud with a FDA stamp. And if you think the system is fair, you’re either paid by Big Pharma or you’ve never had to choose between rent and insulin. I’m done pretending this is about science. It’s about greed. And we’re all just spectators.