Liability and Indemnification in Generic Transactions: What You Need to Know

Dec, 29 2025

Dec, 29 2025

When you sign a contract-whether you're buying a company, licensing software, or hiring a vendor-you're not just agreeing to pay for a service or product. You're also agreeing to take on risk. And that’s where liability and indemnification come in. These aren’t fancy legal buzzwords. They’re real tools that decide who pays when things go wrong. If a customer sues because your product caused harm, or if a tax audit turns up unpaid liabilities from before the sale, who covers it? The answer is buried in the fine print. Most people skip over those pages. Big mistake.

What Indemnification Actually Means

Indemnification is simple in concept: one party promises to pay the other for losses caused by specific events. Think of it as insurance written into the contract. If the seller misled you about the company’s debt, and you get hit with a $500,000 tax bill because of it, the indemnification clause says: "The seller pays you back." It’s not about blame-it’s about predictability. You want to know, before you sign, who’s on the hook if something breaks later.

This isn’t optional in business deals. Nearly every commercial contract includes it. From software licenses to mergers, indemnification is the safety net. But here’s the catch: it’s not automatic. It only kicks in if the contract says so-and exactly how it says so matters more than you think.

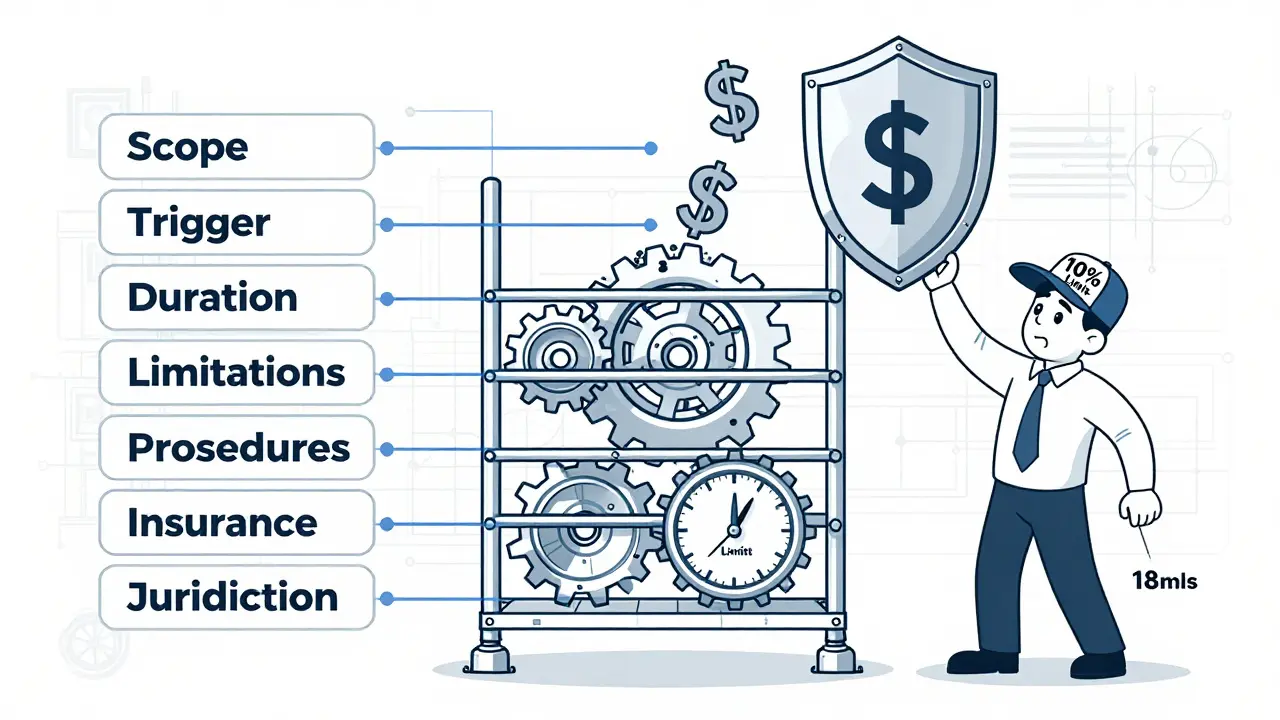

The Seven Parts of a Solid Indemnification Clause

A weak indemnification clause is worse than none at all. It gives a false sense of security. A strong one has seven key pieces:

- Scope of Indemnification - What exactly is covered? Legal fees? Third-party lawsuits? Lost profits? Some clauses only cover direct damages. Others include attorney costs, settlement payments, and even reputational harm. If it’s not listed, it’s probably not covered.

- Triggering Events - What makes the obligation kick in? Breach of contract? Negligence? Intellectual property infringement? If your vendor’s code violates someone’s patent, and the contract says they’ll indemnify you for IP claims, you’re covered. If it doesn’t mention IP, you’re on your own.

- Duration - How long does this protection last? Some clauses expire when the contract ends. Others stick around for years. In mergers, buyers often demand that key representations (like ownership of assets or tax compliance) survive for 18 to 36 months after closing.

- Limitations and Exclusions - There’s always a cap. Maybe the seller won’t pay more than the purchase price. Maybe they won’t cover indirect damages like lost business. Some contracts exclude punitive damages entirely. Know the limits before you sign.

- Claim Procedures - You can’t just send a letter and expect cash. Most contracts require written notice within 30 to 60 days. You might need to give them control over your defense. If you settle without their approval, they might refuse to pay.

- Insurance Requirements - Is the indemnifying party required to carry insurance? If so, how much? A $1 million liability policy means nothing if the claim is $5 million. Ask for proof of coverage, not just a promise.

- Governing Law and Jurisdiction - Where will disputes be settled? In New York? California? The law varies by state. Some states limit indemnification for negligence. Others enforce it broadly. This choice can make or break your protection.

Unilateral vs. Mutual: Who’s Really Protected?

Not all indemnification is equal. There are two main types:

- Unilateral - Only one party pays. This is common when one side has more power. A big tech company buying software from a small vendor will demand the vendor indemnify them for any copyright claims. The vendor has little choice.

- Mutual - Both sides protect each other. This happens in joint ventures, construction deals, or partnerships where both parties might cause harm. If a subcontractor gets injured on-site, and both parties agreed to mutual indemnity, each covers their own liability.

Unilateral clauses favor the buyer. Mutual clauses balance risk. But mutual doesn’t mean equal. The scope, caps, and triggers still differ. Always check who’s doing the paying-and under what conditions.

Indemnify, Defend, Hold Harmless: What’s the Difference?

These three terms are often thrown together like a legal triple play. But they mean different things:

- Indemnify means pay for losses. If you get sued and lose $200,000, they reimburse you.

- Defend means pay for lawyers. Even if you win, legal fees add up. A good clause requires them to cover your defense costs from day one.

- Hold Harmless means they promise not to sue you back. If you’re accused of causing harm, they agree not to turn around and claim you’re at fault.

Some contracts say “indemnify, defend, and hold harmless.” That’s fine-but it’s redundant in many states. Courts in places like California have ruled that “indemnify” already includes defense. But if you’re in a state with stricter rules, leaving out “defend” could leave you paying your own attorneys. Don’t assume. Write it out.

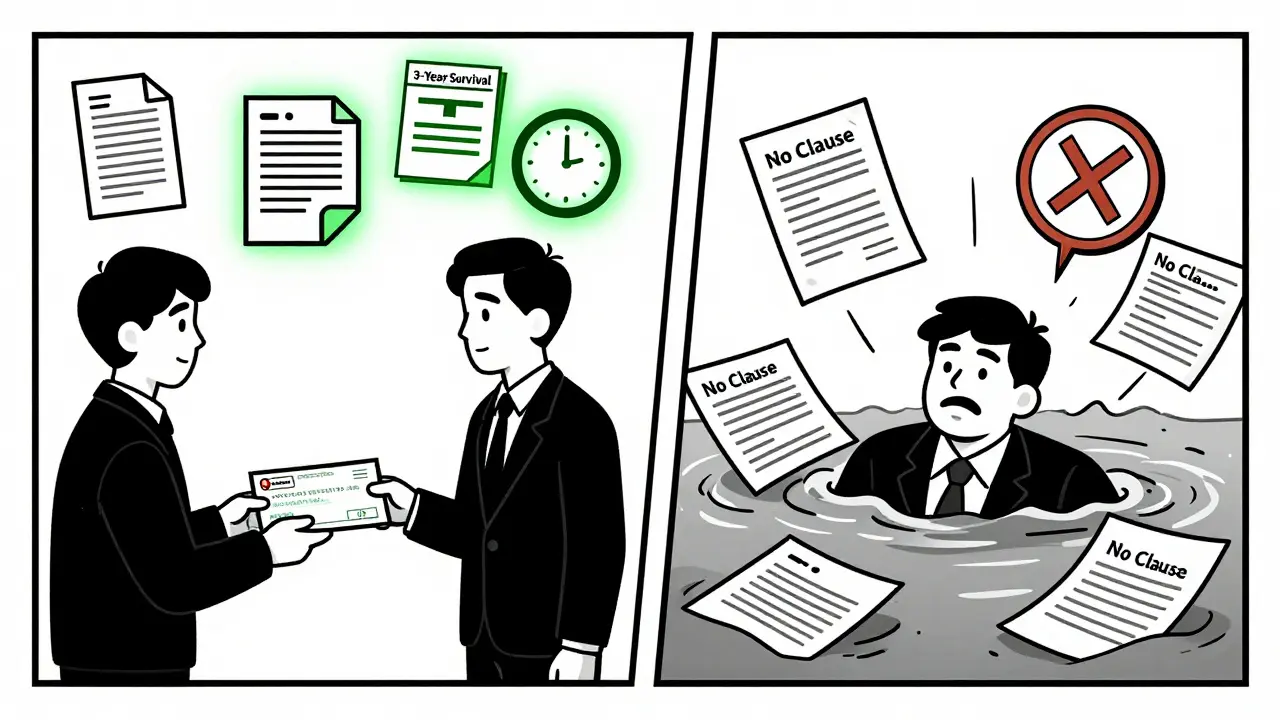

What’s a Fundamental Representation? Why It Matters

In M&A deals, sellers make promises-called representations-about the business. These aren’t just fluff. They’re facts you’re relying on to make the deal. There are two types:

- Fundamental - Core truths: Do they own the company? Are they legally allowed to sell it? Is there hidden debt? These usually survive for 3+ years after closing.

- Non-fundamental - Operational details: Employee benefits, software licenses, environmental compliance. These often expire after 12 to 18 months.

If a seller lies about ownership of intellectual property (a fundamental rep), you have years to find out and demand payment. If they misstate how many employees are on the payroll (a non-fundamental rep), you might have only a year to act. Know the difference. It affects your leverage.

Why Sellers Hate Indemnification Clauses

Sellers don’t fight these clauses because they’re mean. They fight because they’re dangerous. A broad indemnity can expose them to unlimited liability long after the deal closes. Imagine selling your business for $10 million-and three years later, a former employee sues for discrimination, claiming the company failed to train staff properly. If the contract says you’re liable for “any breach of covenant,” you’re on the hook.

Smart sellers push back with:

- Cap on liability - “We won’t pay more than 10% of the purchase price.”

- Deductible (or basket) - “You only get paid if losses exceed $100,000.”

- Time limits - “No claims after 18 months unless it’s about taxes or ownership.”

These aren’t tricks. They’re realistic. No seller can predict every future problem. The goal isn’t to avoid responsibility-it’s to avoid ruin.

Real-World Examples: When Indemnification Saves (or Costs) Millions

Let’s say you buy a SaaS company. Two months later, a customer sues because the software leaked their credit card data. The contract says the seller will indemnify you for “data breaches caused by their negligence.” You win. The seller pays your legal fees, the settlement, and the cost of notifying customers.

Now, imagine the same deal-but the clause says “only for breaches caused by their failure to comply with security standards.” No mention of negligence. The seller argues their system met industry standards, even if it was outdated. Now you’re stuck paying.

Another example: A contractor signs a mutual indemnity on a construction project. A worker falls from scaffolding. The worker sues both the contractor and the property owner. Because the contract says both parties must indemnify each other, each covers their own legal costs. Without that clause, the property owner might have been forced to pay everything.

These aren’t hypotheticals. They happen every day.

What to Do Before You Sign

Don’t wait for a lawsuit to find out your indemnification clause is useless. Here’s what to do:

- Read the clause line by line. Don’t rely on your lawyer to summarize it.

- Ask: “What’s the worst thing that could go wrong?” Then check if it’s covered.

- Verify insurance coverage. Request a certificate of insurance, not just a promise.

- Check the survival period. Is it long enough for the risks you’re taking?

- Don’t accept boilerplate. If it looks like a template from five years ago, ask for an update.

Indemnification isn’t about trust. It’s about documentation. You can trust someone with your business-and still need a clause that protects you if they make a mistake.

What Happens If There’s No Indemnification Clause?

Then you’re relying on the law. And the law doesn’t care about your deal. If someone breaches a contract, you can sue for damages-but proving fault, calculating losses, and fighting in court takes time and money. There’s no guarantee you’ll recover everything. And if the other party goes bankrupt? Good luck.

Indemnification turns a messy lawsuit into a clean payment. It removes guesswork. That’s why it’s in nearly every commercial agreement. Skipping it isn’t saving time. It’s gambling.

Bottom line: If you’re signing a contract, the indemnification clause is just as important as the price. Treat it like a warranty. If you wouldn’t buy a car without one, don’t sign a deal without one.

Aayush Khandelwal

December 30, 2025 AT 14:33Man, this breakdown is straight fire. Indemnification isn't just legalese-it's your financial Kevlar. I've seen startups get wrecked because they signed a boilerplate clause that said 'indemnify for any third-party claims'-no caps, no exclusions. One patent troll later, founder's selling his Tesla to pay lawyers. Don't be that guy. Read the damn thing. And if your lawyer says 'it's standard,' ask them to define 'standard'-because standard is often just lazy.

Sandeep Mishra

January 1, 2026 AT 10:06Love how you framed this as a safety net-not a trap. It's funny how we rush to sign contracts like they're concert tickets, but forget that a bad clause can haunt you for years. I always tell my mentees: if you wouldn't bet your rent on it, don't sign it. Indemnification is the silent guardian of your business soul. Treat it with reverence, not rush.

🙏

Hayley Ash

January 3, 2026 AT 03:25Wow what a groundbreaking insight-indemnification clauses matter. Next you'll tell us oxygen is important or that water is wet. I mean, really? You wrote 2000 words on this? Did you get paid by a law firm to write this? Or are you just trying to justify your 300/hr consulting rate? Classic overcomplication of the obvious.

kelly tracy

January 3, 2026 AT 14:55This is why small businesses die. You think you're protected by some clause but guess what-most sellers don't have insurance. They don't have assets. They're shell companies with zero net worth. You think a $10M indemnity clause means anything when the guy who sold you the company lives in a van in Oregon? This is theater. Legal theater. And you're the audience paying for the tickets. Stop pretending contracts are shields. They're just paper with fancy words.

Cheyenne Sims

January 4, 2026 AT 21:23There are numerous grammatical and structural deficiencies in this article. The use of passive voice is excessive. The transition between sections lacks cohesion. Furthermore, the phrase 'big mistake' is colloquial and unprofessional for a business context. Indemnification clauses are governed by state-specific statutes, not anecdotes. The examples provided are not cited, and no jurisdictional authority is referenced. This content lacks academic rigor and should be revised accordingly.

Glendon Cone

January 5, 2026 AT 01:39Big fan of the 'fundamental vs non-fundamental' breakdown-that's gold. I just closed a deal last month where the seller tried to weasel out of a tax liability by saying it was 'non-fundamental.' We had the clause nailed: 'any breach of representation regarding tax compliance survives indefinitely.' They paid. No court. Just a signed letter and a wire transfer.

Also, if you're using 'hold harmless' without 'defend'-you're leaving money on the table. Ask your lawyer to spell it out. And yes, emojis: 🛡️💸

Henry Ward

January 6, 2026 AT 02:30Everyone here is acting like this is some deep secret. It's not. This is LAW 101. If you're signing a contract without understanding indemnification, you deserve to get screwed. You're not a victim-you're negligent. People like you are why litigation costs are out of control. You don't read the fine print? Then you're not a businessperson. You're a tourist with a credit card. Stop pretending you're smart. You're not.

Joseph Corry

January 7, 2026 AT 03:43One cannot help but observe the Hegelian dialectic unfolding here: the thesis of contractual certainty versus the antithesis of human fallibility. Indemnification, then, becomes the synthesis-a fragile, bureaucratic monument to our collective fear of chaos. But is it not ironic that we seek to codify unpredictability? The clause is a ritual, not a solution. The real indemnification is emotional: the peace of mind that comes from believing, against all evidence, that someone else will pay when the world breaks. How profoundly human.

Colin L

January 9, 2026 AT 01:36Look, I’ve been in this game since 2008, and let me tell you, I’ve seen every variation of indemnity clause under the sun-from the hyper-narrow ‘only covers direct damages caused by willful misconduct’ to the absurdly broad ‘indemnify for any and all losses, foreseeable or not, direct or indirect, including emotional distress and lost sleep.’ And here’s the thing nobody talks about: the real power isn’t in the clause-it’s in the relationship. I once had a seller who refused to cap liability, but when the claim came in, he paid it all without a fight because we’d had lunch together every Tuesday for six months. Contracts are tools, sure, but people are the real enforcement mechanism. So don’t just read the clause-build the trust. And if you don’t know who you’re dealing with? Walk away. No clause can save you from a bad actor.

srishti Jain

January 9, 2026 AT 02:58Read the clause. Or get owned. That’s it.