Insurance Changes and Generic Switching: Navigating Formulary Updates in 2025

Nov, 12 2025

Nov, 12 2025

Every January, millions of people on Medicare Part D wake up to a surprise: their medication is no longer covered the same way-or at all. It’s not a mistake. It’s a formulary update. These are the lists of drugs your insurance plan will pay for, and every year, they change. In 2025, those changes are bigger than ever, thanks to the Inflation Reduction Act. If you take any regular prescription-especially for diabetes, arthritis, or heart disease-you need to know what’s coming.

What’s Actually Changing in 2025?

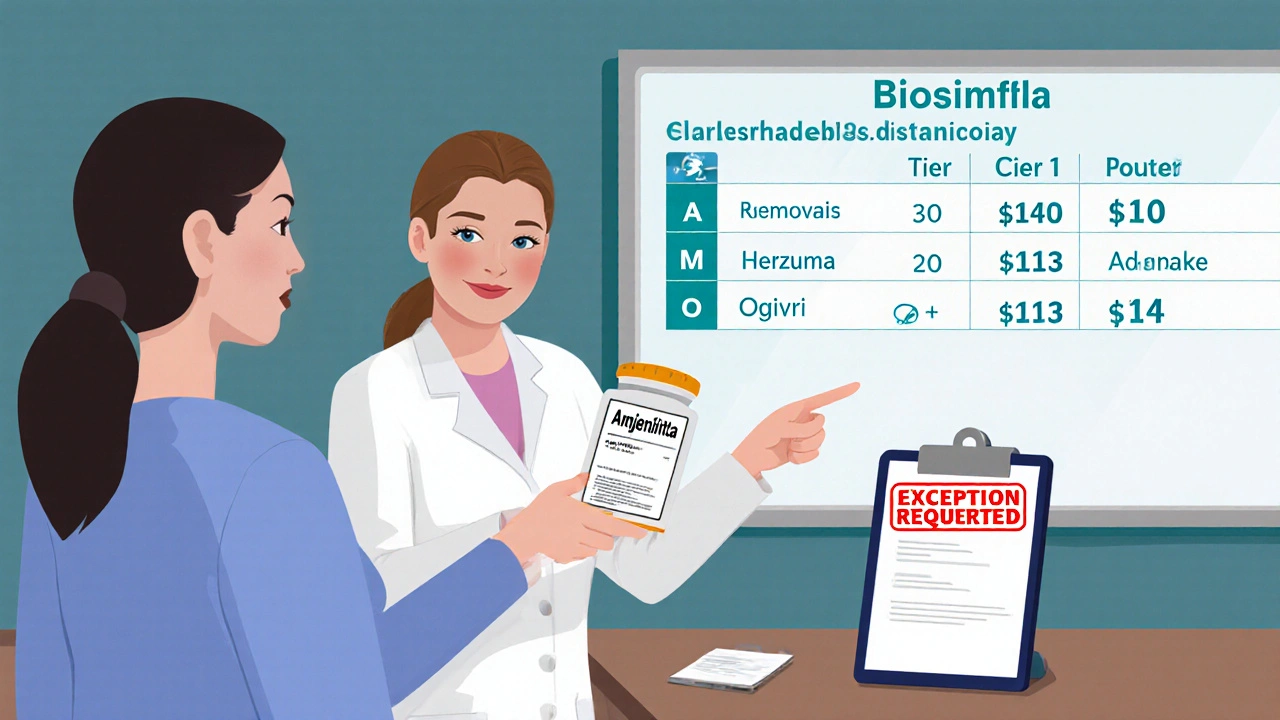

The biggest shift isn’t just about which drugs are covered. It’s about how much you pay. Starting January 1, 2025, Medicare Part D plans have a new $2,000 annual cap on out-of-pocket drug costs. That means if you spend $2,000 on your meds this year, the plan pays 100% after that. For someone taking expensive biologics like Humira or Enbrel, that could mean saving $3,000 or more. But here’s the catch: to make this cap work, insurers are pushing harder than ever to get you onto cheaper drugs. That’s where generic switching comes in. You might be on a brand-name drug that’s worked fine for years. But now, your plan says you have to switch to a generic version-or even a biosimilar-because it’s cheaper.How Formularies Work Now

Insurance plans group drugs into tiers. The lower the tier, the less you pay. In 2025, here’s what that looks like:- Tier 1: Preferred generics. Copay: $1-$10

- Tier 2: Non-preferred generics or preferred brands. Copay: around $47

- Tier 3: Non-preferred brands. Copay: around $113

- Tier 4 (Specialty): High-cost drugs. You pay $113 or 25% coinsurance-whichever is higher

Why Insurers Are Pushing Generics-and Biosimilars

It’s not just about saving money for the plan. It’s about surviving the new rules. The Inflation Reduction Act forces insurers to cover certain high-cost drugs at lower prices starting in 2026. That means they’re trying to reduce their exposure now. The fastest way? Get you off expensive brand-name drugs and onto generics or biosimilars. Biosimilars are not the same as regular generics. They’re copies of biologic drugs-complex medicines made from living cells. Think Humira, Enbrel, or Stelara. Biosimilars like Amjevita (for Humira) or Kanjinti (for Herceptin) work almost the same way. And they’re often 15-30% cheaper. In 2024, only 28% of targeted therapies used biosimilars. By 2027, that number could hit 45%. Insurers are betting on that growth. CVS Caremark, for example, added 11 new specialty drugs in 2025-10 of them biosimilars-and removed 9 older ones. UnitedHealthcare moved Humalog insulin to a higher tier, making it cost three times more for some patients.

What Gets Removed? What Gets Added?

Some drugs vanish entirely from formularies. In 2025, CVS Caremark removed nine specialty drugs, including Herzuma and Ogivri. That doesn’t mean they’re unsafe. It means they’re no longer cost-effective for the plan. Meanwhile, new biosimilars are being added fast. The FDA approved 17 new biosimilars in 2024 alone-a 34% jump from the year before. Plans are rushing to cover them because they’re cheaper and now have clearer FDA guidance on safety. You might see your doctor’s prescription suddenly flagged as “not covered.” That doesn’t mean you can’t get it. It means you’ll need to file an exception.What to Do When Your Drug Gets Removed or Moved

You have rights. Insurers must give you 60 days’ notice before changing coverage for a drug you’re already taking. If they’re adding a new generic or biosimilar, they only need 30 days. Here’s your action plan:- Check your formulary between October and December. Your plan sends a notice in the mail. Don’t ignore it. Log in to your plan’s website and search for your drug.

- Call your pharmacist. They see formulary changes every day. Ask: “Is my drug staying on the list? Is there a cheaper alternative?”

- Ask your doctor for an exception. If the new drug won’t work for you, your doctor can request a coverage exception. In 2024, 82% of tiering exceptions were approved. But if your drug was completely removed? Only 47% of those requests got approved.

- Use transitional supply. If your drug is being removed, you’re entitled to a 30-day supply at your old cost. Use that time to get the exception approved or switch safely.

Real Stories: What’s Happening to Real People

One user on Reddit, ‘MedicareWarrior87,’ said their Humalog insulin copay jumped from $35 to $113 overnight. That’s $900 more a year. They filed an exception-and got it approved after 10 days. But they missed two days of insulin during the wait. Another person, ‘ArthriticMom’ on HealthUnlocked, switched from Humira to Amjevita. Her monthly cost dropped from $750 to $300. She felt no difference in pain control. “It’s the same medicine,” she said. “Just cheaper.” But not everyone has that luck. Aetna’s data shows 38% of people who requested exceptions waited 10 to 14 days for a decision. That’s a dangerous gap for someone with diabetes, heart failure, or rheumatoid arthritis.What’s Coming in 2026-and Why It Matters

The biggest change isn’t in 2025. It’s in 2026. The Medicare Drug Price Negotiation Program kicks in. The government will negotiate prices for 10 high-cost drugs-including Stelara, Prolia, and Xolair-and all Part D plans must cover them at those lower prices. That means even if your plan didn’t cover Stelara before, it will in 2026. But here’s the twist: the plan might still try to make you switch to a biosimilar first. And by then, there could be multiple biosimilars on the market. You might not get to choose. Also, plans will be required to cover all drugs in six protected classes-like cancer meds, HIV drugs, and seizure meds-no matter the cost. But outside those classes? Expect more pressure to switch to generics.How to Protect Yourself

You can’t stop formulary changes. But you can control how they affect you.- Don’t wait for a letter. Check your plan’s formulary every fall. Use the Medicare Plan Finder tool.

- Keep a list. Write down every drug you take, the dose, and why your doctor prescribed it. Bring it to every appointment.

- Ask about biosimilars. If your drug is expensive, ask: “Is there a biosimilar? Has it worked for others?”

- Know your exception rights. If your drug is removed, your doctor can request an exception. Don’t assume it’s denied. Ask for help from your pharmacy’s patient advocate.

- Don’t stop your meds. If your drug changes, talk to your doctor before switching. Never stop a chronic medication without medical advice.

Final Thought: It’s Not About the Drug. It’s About the System.

Generic switching isn’t bad. Biosimilars are safe, effective, and save billions. But when insurers push changes without patient input, it creates chaos. The system is designed to cut costs. But if you’re the one paying the price in delayed care, skipped doses, or higher stress, then the system isn’t working right. The answer isn’t to fight generics. It’s to fight for transparency. Know your plan. Know your rights. And don’t let a formulary update decide your health.What happens if my insurance stops covering my medication?

Your insurer must give you at least 60 days’ notice before removing a drug you’re currently taking. During that time, you can request an exception through your doctor. If approved, you can keep your drug at your current cost. If denied, you may qualify for a 30-day transitional supply to help you switch safely.

Are biosimilars safe to switch to?

Yes. The FDA requires biosimilars to be “highly similar” to the original drug with no clinically meaningful differences in safety or effectiveness. Over 17 were approved in 2024, and real-world data shows most patients experience the same results at a fraction of the cost. Many patients report no change in symptoms after switching.

Can I choose not to switch to a generic?

You can refuse, but your plan won’t pay for the brand-name drug unless you get an exception approved by your doctor. The exception must show medical necessity-like a history of allergic reaction or poor response to generics. If approved, you’ll pay the higher tier cost. If denied, you’ll need to pay out of pocket or switch.

How do I find out if my drug is affected?

Check your plan’s annual notice of changes, usually mailed in October. You can also search your drug on your insurer’s website using their formulary tool. The Medicare Plan Finder (medicare.gov/plan-compare) lets you compare coverage across plans. Your pharmacist can also check it for you.

What if I can’t afford the new copay?

You may qualify for Extra Help (Low-Income Subsidy) through Medicare, which reduces out-of-pocket costs. Some drug manufacturers offer patient assistance programs. Nonprofits like NeedyMeds and Patient Access Network Foundation can help with co-pays. Talk to your pharmacist-they often know about these programs.

Will the $2,000 cap apply to all my drugs?

Yes, starting January 1, 2025, all covered Part D drugs count toward the $2,000 out-of-pocket cap. This includes generics, brand-name drugs, and biosimilars. Once you hit the cap, your plan pays 100% for the rest of the year. This applies to everyone on Medicare Part D, regardless of income.

Are there drugs that can’t be switched?

Yes. Six classes of drugs are protected by law and cannot be restricted: cancer drugs, HIV/AIDS treatments, anticonvulsants, immunosuppressants, antidepressants, and antipsychotics. Insurers must cover at least two drugs in each category. But outside these classes, switching is common-and often mandatory.

Nicole M

November 13, 2025 AT 19:59Just got my notice in the mail. My Humira’s moving to Tier 4. My copay’s going from $50 to $180. I’m not even mad, just exhausted. This isn’t healthcare, it’s a spreadsheet with a stethoscope.

Arpita Shukla

November 15, 2025 AT 14:10Everyone’s talking about biosimilars like they’re magic pills. But have you tried switching from a biologic you’ve been on for 7 years? My knees locked up for two weeks after going from Enbrel to Amjevita. They called it ‘adjustment period.’ I called it ‘being treated like a lab rat.’ The FDA says it’s ‘clinically equivalent’-but my body didn’t get the memo.

Mark Rutkowski

November 17, 2025 AT 13:46There’s a quiet violence in the way this system operates. We’re told to ‘take control’ of our health, to ‘advocate’ for ourselves, to ‘check our formularies’-as if the burden of navigating a labyrinth designed by actuaries should fall on the shoulders of people already drowning in chronic illness. The $2,000 cap is a bandage on a hemorrhage. It doesn’t fix the fact that your life is now subject to quarterly budget reviews by people who’ve never held a prescription bottle in their hands.

Generics aren’t the enemy. The enemy is a system that treats human bodies like line items in a PowerPoint deck.

Ryan Everhart

November 18, 2025 AT 21:02So let me get this straight. The government’s gonna negotiate drug prices in 2026 but insurers are still gonna force you onto biosimilars first? Like, congrats, we saved you money… by making you jump through more hoops. Next year they’ll probably make you sign a waiver saying you’re okay with your immune system being used as a beta test.

Alex Ramos

November 18, 2025 AT 21:37Hey everyone-just wanted to share a quick tip. If your drug gets removed, don’t panic. Call your pharmacy’s patient advocate. They’re paid to help you. I got my Stelara exception approved in 4 days because my pharmacist knew the right form to fill out. Also, check NeedyMeds.com-there’s a $500 copay coupon for Amjevita right now. Seriously, it’s free money if you know where to look.

And yes, biosimilars work. I switched from Humira to Amjevita. No flare-ups. No side effects. Just $400 less a month. I’m not a doctor, but I’ve been on this drug for 5 years. It’s the same medicine, just cheaper. Don’t let fear stop you from saving your wallet.

manish kumar

November 19, 2025 AT 18:45As someone who’s been managing rheumatoid arthritis for over a decade and now lives in India but still uses US-based insurance through a global employer plan, I’ve seen this play out in multiple countries. The formulary changes aren’t unique to the US-they’re global, but the US system is uniquely cruel because it ties survival to bureaucratic gymnastics. In India, we don’t have Medicare, but we have access to generic biosimilars at 1/10th the price. Here, you have to file paperwork, wait 10 days, risk missing doses, and still pay $100+ if they deny you. The Inflation Reduction Act sounds great on paper, but for people like me who cross borders for care, it’s just another layer of confusion. Why can’t the system just say: if it’s safe, cover it? Why does cost always override clinical judgment? I’m not asking for luxury-I’m asking for dignity. And if you think biosimilars are ‘just as good,’ try telling that to someone who had a bad reaction because their body adapted to a specific batch of a brand-name drug over 8 years. The science says they’re equivalent. The lived experience says otherwise. We need more than cost savings-we need trust.

David Barry

November 21, 2025 AT 00:59Let’s be real. The $2,000 cap is just a PR stunt. Insurers knew this was coming. They’ve been pushing generics for years. The real win? They offloaded $30B in liability onto patients before 2026. Now they’re just waiting for the government to cap prices on the last 10 drugs. Meanwhile, you’re stuck choosing between insulin and rent. Congrats, America. You’ve turned healthcare into a high-stakes game of Jenga.

Alyssa Lopez

November 22, 2025 AT 11:52OMG I just found out my diabetes med got moved to tier 3. Like wtf. I mean seriously? We pay for this crap and then they just swap our meds like its a video game? This is why america is falling apart. No wonder people are dying. Insurers are just corporate vultures. I hope they all burn.

edgar popa

November 22, 2025 AT 12:53Just switched to the biosimilar. My bill dropped from $700 to $280. No side effects. My doc said I’m fine. Don’t overthink it. Your body doesn’t care what the label says.

Eve Miller

November 22, 2025 AT 18:55It’s irresponsible to suggest biosimilars are ‘just as good’ without acknowledging the subtle, documented differences in immunogenicity profiles across patient populations. The FDA’s ‘no clinically meaningful difference’ standard is a regulatory loophole, not a clinical guarantee. To equate biosimilar efficacy with originator biologics is to ignore pharmacovigilance data from the EU’s EMA, which shows higher rates of anti-drug antibody formation in certain autoimmune cohorts. This isn’t ‘saving money’-it’s experimental medicine disguised as policy.

Chrisna Bronkhorst

November 23, 2025 AT 21:34My dad’s on insulin. His copay went from $30 to $110. He skipped doses for three weeks because he couldn’t afford it. Then he got sick. Hospital bill: $14,000. Insurance paid $8,000. He paid $6,000. So the system saved $2,000 on his meds… and cost him $6,000 in ER visits. Who won? The insurance company. They made $4,000. And now they’re patting themselves on the back for a $2,000 cap. This isn’t healthcare. It’s a Ponzi scheme with syringes.