Chinese Generic Production: Manufacturing and Quality Concerns in Global Pharma

Dec, 1 2025

Dec, 1 2025

When you take a generic pill for high blood pressure, diabetes, or antibiotics, there’s a better than 70% chance the active ingredient inside came from China. That’s not a guess-it’s fact. As of 2023, Chinese manufacturers produce about 80% of the world’s active pharmaceutical ingredients (APIs), the raw chemical building blocks of nearly every generic drug sold globally. But behind that staggering scale is a story of cost, risk, and growing tension between supply and safety.

Why China Dominates Generic Drug Production

China didn’t become the world’s API powerhouse by accident. After joining the World Trade Organization in 2001, the government poured billions into building chemical plants, training engineers, and relaxing environmental rules to attract foreign investment. By 2015, China had become the go-to source for cheap, high-volume APIs. Today, companies like Sinopharm and Shijiazhuang Pharma Group churn out 500 to 2,000 metric tons of key ingredients per year-far more than any U.S. or European plant can match. The secret? Vertical integration. Chinese manufacturers control nearly 70% of the entire production chain-from raw chemicals to final API-cutting out middlemen and slashing costs. A kilogram of metformin or amoxicillin API from China costs $50-$150. The same thing from Europe or the U.S. runs $200-$400. For drugmakers trying to keep prices low, the math is irresistible. But here’s the catch: volume doesn’t equal reliability. While China leads in simple, high-volume APIs, it lags badly in complex drugs like biologics, inhalers, or injectables. It holds less than 5% of the global market for those. And even in the areas it dominates, quality control remains uneven.What Goes Wrong in Chinese API Factories

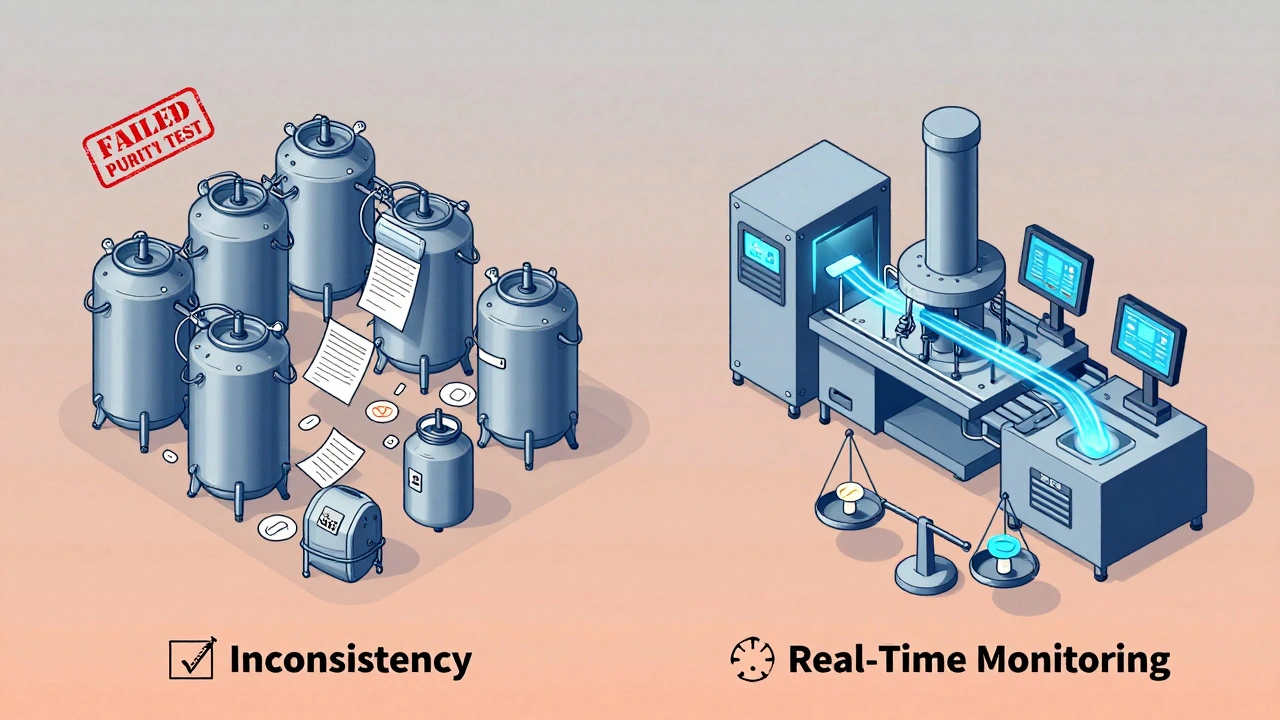

The U.S. Food and Drug Administration (FDA) has issued over 1,200 warning letters to Chinese pharmaceutical facilities since 2015. The most common problems? Inadequate lab controls (78% of inspections), poorly validated manufacturing processes (65%), and data falsification (52%). One 2023 FDA study found that 12.7% of API samples from China failed purity tests. Compare that to 1.8% from U.S. facilities and 2.3% from Europe. That’s not a small gap-it’s seven times higher. The issues aren’t always about dirty factories. Often, it’s about outdated methods. While U.S. and European plants have moved to continuous manufacturing-where chemicals flow through connected systems in real time-65% of Chinese API production still uses old-school batch processing. That means each batch is made separately, increasing the chance of inconsistency. One bad batch can contaminate thousands of pills. Then there’s the documentation problem. A 2023 survey by PhRMA found 37% of U.S. drugmakers reported falsified paperwork from Chinese suppliers. One case that made headlines: Huahai Pharmaceutical’s contaminated valsartan API led to a 2018 global recall of over 100 million blood pressure pills. The contamination wasn’t random-it came from a poorly controlled chemical reaction that had been ignored for years.The India-China Supply Chain Tangle

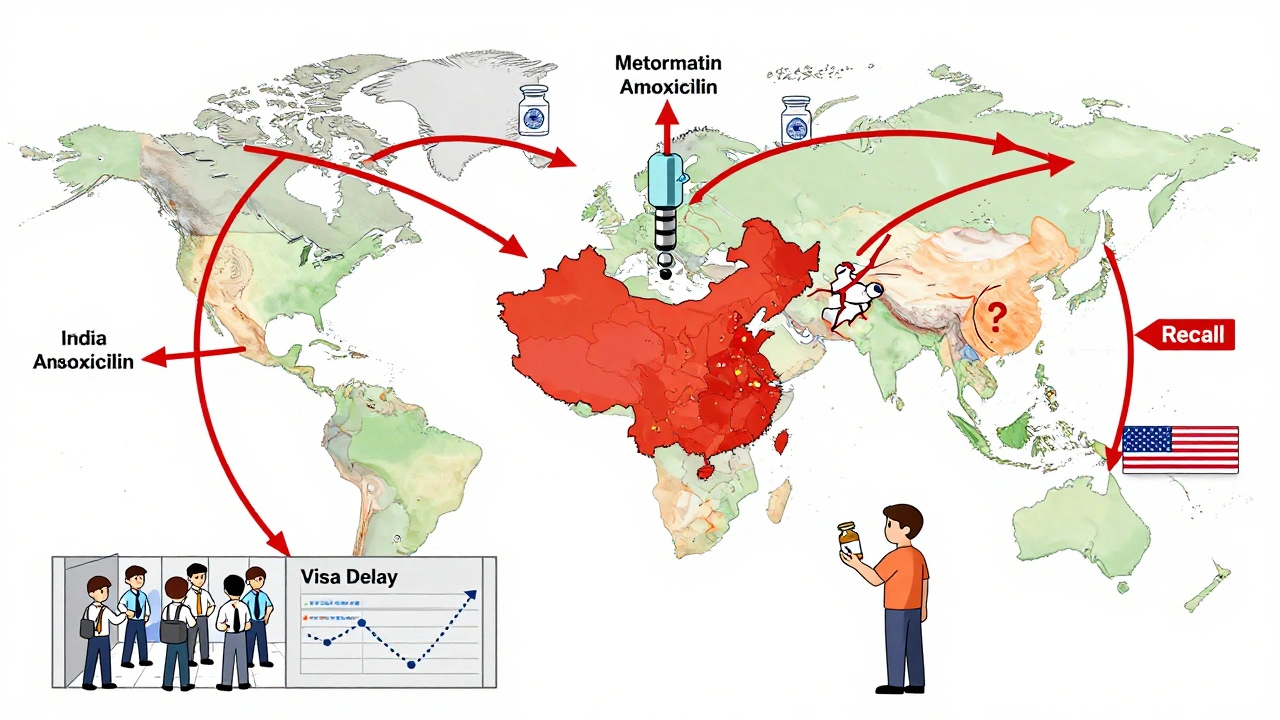

India is the world’s largest exporter of finished generic pills. But here’s the twist: India imports 65% of its APIs from China. So when a Chinese plant fails an FDA inspection, the ripple effect hits Indian drugmakers-and then you, the patient. Zydus Pharmaceuticals, an Indian company, recalled 1.2 million bottles of blood pressure medication in 2023 after discovering sub-potent API from a Chinese supplier. The pills weren’t dangerous-they just didn’t work as well. That’s the quiet crisis: drugs that are safe but ineffective. No one gets sick right away. But over time, patients with chronic conditions like diabetes or heart disease don’t get the full benefit. Their conditions worsen. And no one knows why. Meanwhile, Chinese companies export only 5-7% of finished drug formulations. They make the ingredients, but others package them. That’s why the U.S. imports 88% of its APIs from overseas-and 28% of those come from China. It’s a single point of failure in a system that keeps millions alive.

Regulatory Reforms-Too Little, Too Late?

In 2016, China launched the Generic Consistency Evaluation (GCE) program to fix its reputation. The goal? Make sure every generic drug works just like the brand-name version. Sounds reasonable. But as of 2024, only 35% of approved generics have passed the test. The rest? Still on the market, with no proof they’re equivalent. The NMPA (China’s drug regulator) has shut down 4,500 non-compliant factories since 2018. That’s good. But the remaining 2,500 still operate under a system that prioritizes speed over scrutiny. The priority review pathway for domestic drugs cuts approval time from 200 days to 130. But for generics? No such shortcut. And here’s the real problem: the FDA can’t inspect Chinese plants like it inspects U.S. ones. Dr. Margaret Hamburg, former FDA commissioner, said in 2024 that inspections in China happen at one-tenth the rate of domestic ones. Why? Access restrictions. Political friction. Visa delays. It’s not that the FDA doesn’t want to check-they can’t.What’s Being Done to Fix It

China knows it’s under pressure. Its 2024 ‘Pharma 2035’ plan promises $22 billion to upgrade technology, switch to continuous manufacturing, and improve data systems. By 2026, 30% of high-volume APIs must be made using modern continuous processes. By 2027, the number of FDA-inspected plants should jump from 187 to 500. Meanwhile, the U.S. and EU are pushing back. The CHIPS and Science Act in America allocated $500 million to rebuild domestic API production. The EU’s 2024 Pharmaceutical Strategy aims to cut Chinese API imports from 80% to 40% by 2030. India and Vietnam are stepping in to fill the gap, building new API plants with Western-style quality controls. But shifting supply chains isn’t easy. Building an FDA-compliant API plant in China costs $85-$120 million. In the U.S., it’s $70 million. But if you want to make it compliant with both Chinese and U.S. rules? Add another $20 million for training, documentation overhaul, and process alignment. Pfizer spent $22 million and three years harmonizing its joint venture with Huahai before the FDA approved it.

What This Means for You

If you’re on a generic drug, you’re probably fine. Most Chinese-made APIs are safe. But the risk isn’t zero. And it’s growing. The cost savings are real. Switching to Chinese API saved one U.S. company $4.2 million a year on amoxicillin. But that same company saw a 15% higher rejection rate. That means more testing, more delays, more waste. And if a batch fails after it’s already in your medicine cabinet? That’s not a supply chain issue-it’s a patient safety issue. A 2024 Gartner survey of 150 pharma companies showed Chinese suppliers scored 3.2 out of 5 for quality consistency. European suppliers scored 4.1. But Chinese suppliers scored 4.7 for price and 4.5 for capacity. That’s the trade-off: cheaper, faster, but less reliable. There’s no magic fix. The world needs cheap generics. Billions of people rely on them. But we can’t afford to ignore the cracks.What You Can Do

You can’t control where your drugs are made. But you can stay informed. - Check if your generic drug has been recalled. The FDA database is public. Search by drug name. - Ask your pharmacist: “Is this made in China?” If they don’t know, ask for the manufacturer’s name. Then look it up. - If you notice a change in how your medication works-less effective, more side effects-tell your doctor. It might be a bad batch. - Support policies that fund domestic API production. It’s not about nationalism. It’s about resilience. The system isn’t broken. But it’s stretched thin. And when you’re taking a pill every day for your heart, your blood sugar, your thyroid-you don’t want to be the weak link.Are all Chinese generic drugs unsafe?

No. Most Chinese-made generic drugs are safe and effective. But the risk of quality issues is higher than with drugs made in the U.S., EU, or even India. The FDA has approved thousands of Chinese facilities, and many meet international standards. The problem isn’t all Chinese drugs-it’s the inconsistency. Some batches are flawless. Others fail purity or potency tests. That’s why inspections and transparency matter.

Why doesn’t the FDA just ban Chinese APIs?

Because over 80% of the world’s APIs come from China. Banning them would cause massive drug shortages. Millions of people rely on affordable generics for conditions like hypertension, diabetes, and epilepsy. Without Chinese production, prices would skyrocket, and access would shrink. The FDA’s strategy is to inspect, warn, and require fixes-not to cut off supply.

How can I tell if my generic drug is made in China?

Look at the drug’s label or package insert. The manufacturer’s name and location are required. If it says “Made in China” or lists a Chinese company like Huahai, Sinopharm, or Shijiazhuang Pharma, the API likely came from China. You can also search the FDA’s Drug Registration and Listing System (DRLS) by the drug’s active ingredient. It will show you where the API is manufactured.

Is India a safer alternative to China for generic drugs?

India has better quality control records than China and is the largest exporter of finished generic drugs. But India still gets most of its API from China-65%. So even Indian-made pills often contain Chinese ingredients. India is better at packaging and testing, but it’s not immune to the same supply chain risks. A truly safer system requires diversification-not just swapping one supplier for another.

What’s being done to improve quality in Chinese factories?

China is investing heavily. The 2024 ‘Pharma 2035’ plan includes $22 billion to upgrade facilities, adopt continuous manufacturing, and improve data systems. The NMPA now requires electronic submissions and plans to inspect 500 facilities for FDA compliance by 2027. Some companies, like Huahai and Sinopharm, have spent tens of millions to meet Western standards. But progress is slow. Only 35% of generics have passed the consistency evaluation. Real change will take years.

Saurabh Tiwari

December 2, 2025 AT 21:11Anthony Breakspear

December 4, 2025 AT 06:43Zoe Bray

December 4, 2025 AT 22:59Girish Padia

December 6, 2025 AT 05:09Saket Modi

December 6, 2025 AT 11:03Chris Wallace

December 8, 2025 AT 09:33John Webber

December 8, 2025 AT 10:40Shubham Pandey

December 10, 2025 AT 09:28Elizabeth Farrell

December 12, 2025 AT 07:34